Budget to reflect IMF dictation

Shawdesh Desk:

The new national budget to be announced on June 6 will reflect conditions attached by the International Monetary Fund under the current $4.7 billion loan progarmme.

From the budget deficit to tax collection or rationalisation of subsidy to social safety spending, all will be projected in the FY25 budget in line with commitments towards the IMF, said Finance Division officials.

Besides, separate publications on debt and climate change will be highlighted among the budget documents by the suggestion from the Washington-based multilateral lender, said the officials.

Economists said that the government was failing to improve the budget implementation and the sliding economic condition despite maintenance of conditions from the IMF since 2023.

The IMF has already disbursed $1.1 billion and hinted at disbursement of $1.15 billion in the current month.

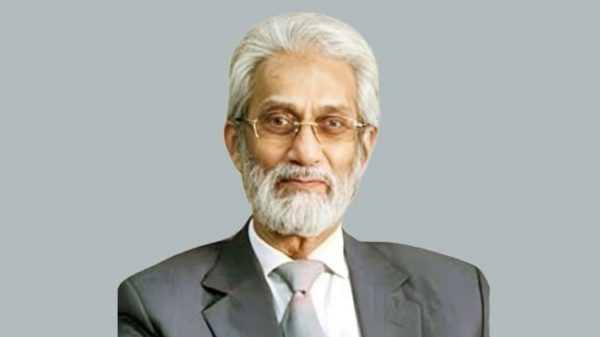

Finance minister Abul Hassan Mahmood Ali, who will announce the new budget in the parliament, is eagerly waiting for the disbursement against the backdrop of a weakened forex reserve, which waned now to around $18 billion from $48 billion in August 2021.

Due to shortage of dollars, the government cannot clear payment for the import of energy by the state-owned Power Development Board despite budgetary allocation and support in form of bonds, said the finance ministry officials.

On Wednesday, an Adani Group official met the finance minister seeking measures for quick payment of arrears for the purchased power by the PDB from its power plant in the Indian state of Jharkhand.

Policy Research Institute executive director Ahsan H Mansur said that the disbursement of the IMF next tranche became crucial for the government amid the dollar shortage.

The finance ministry had already convinced the IMF to substantially increase the loan amount in the next tranche, he said, adding that the finance minister had little option to ignore commitments towards the IMF regarding the new budget.

Finance ministry officials said that an increase of revenue by 0.5 per cent of GDP and keeping budget deficit within 4.6 per cent of the GDP will be included in the FY25 budget.

The power price will be increased in the next winter to keep the overall budget subsidy on check, said the officials, adding that the power division was reluctant to hike the power price in summer fearing further inflation and criticisms.

They also said that a document on overall debt scenario will be made public in the coming budget by the IMF recommendations.

The document will feature the overall debt of the government and future strategies for the management of debt in the context of its growing trend and low revenue generation.

Talking to reporters on Thursday, state minister for finance Waseqa Ayesha Khan said that a publication analysing the impacts of climate change would be among the documents of the new national budget.

Officials said that the IMF wanted the finance ministry to take a series of measures in the new financial year on the climate change issues in line with the ‘resilience and sustainability facility’, a major component of the current loan programme.

Former World Bank Dhaka office chief economist Zahid Hussain, however, observed that the government had been realising concession from the IMF on vital issues such as revenue collection.

The IMF agreed to give concession on the revenue collection target set under the June performance indicators. The revenue collection target set at Tk 3.94 lakh crore for June FY24 is likely to be revised down by around Tk 10,000 crore, according to the finance ministry officials.

The FY25 collection is also likely to be revised down from the earlier projection.

Zahid Hussain noted that revenue collection was one of the weakest points of the government as well as of the overall budget management.

Low revenue generation has been forcing the government to depend on borrowing from local and foreign sources.

The government’s overall debt surged to Tk 16,59,334 crore until December 2023 from Tk 11,44,296 crore in June 2021, according to the Debt Bulletin of the Finance Division.

Of the total amount until the past year, the government’s domestic debt stood at 9,53,814 crore and external debt at Tk 7,05,520 crore.

Leave a Reply